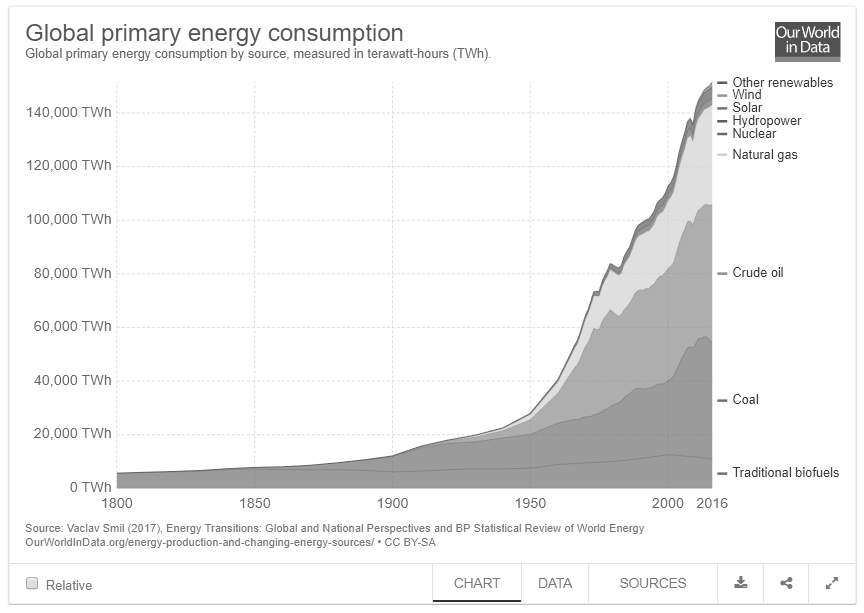

The energy transition is the movement from fossil fuels to renewables as the primary source for energy generation. What determines the start and endpoint of an energy transition? This is not an easy question to answer since many energy systems are in a constant state of flux, albeit very slowly in many cases. In terms of national primary energy use, Smil (2010) argues that the time when a new energy source captures five percent of total energy demand is a reasonable benchmark for the start of a transition.

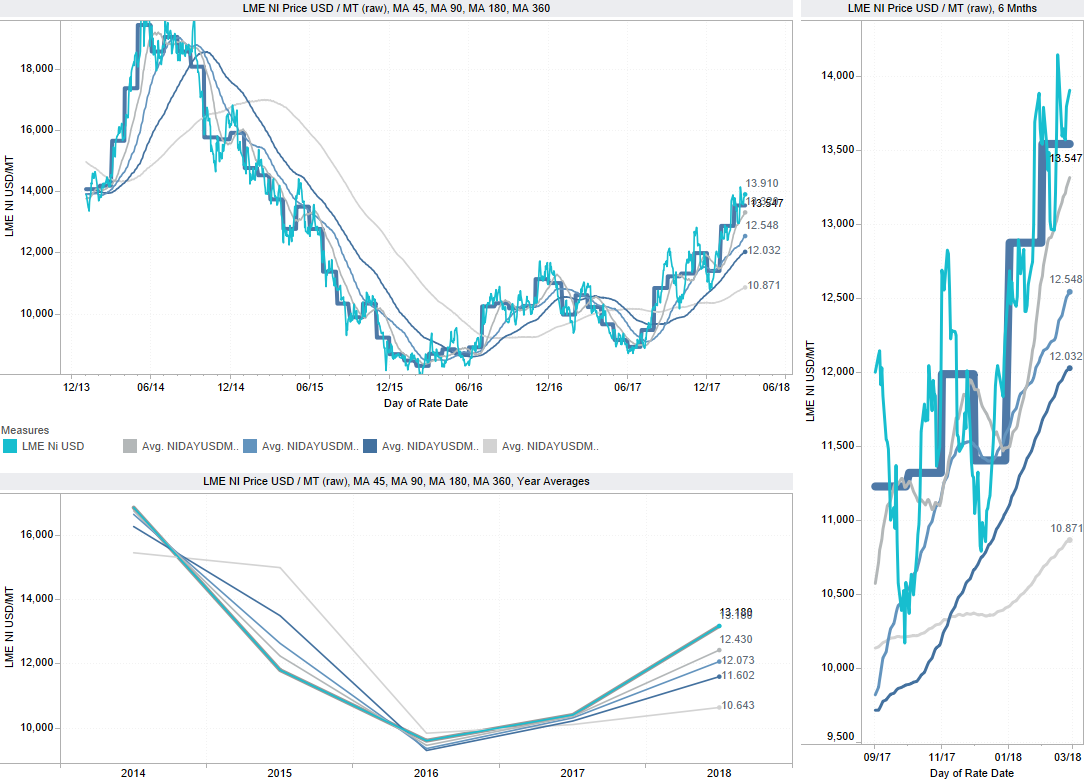

In 2015, the world consumed 146,000 terrawatt-hours (TWh) of primary energy of which 62% carbon fuels and 32% renewables (hydro, wind, nuclear, solar and bio mass).

- Up to the industrial revolution (18th century), mankind's use of energy relied only on muscular and biomass sources. Most work was provided by manual labor and animals, while the biomass (mainly firewood) provided for heating and cooking energy needs. Other sources of energy, such as windmills and watermills, were present but their overall contribution was marginal and very specific (e.g. milling flour).

- By the mid 19th century, the industrial revolution brought a major shift in energy sources with the usage of coal, mainly for steam engines, but increasingly for power plants.

- As the 20th century began, the major reliance was on coal, but a gradual shift towards higher energy content sources like oil began. This second major shift saw the introduction of internal combustion engines and of oil-powered ships.

- In the late 20th century, preeminence of petroleum products as the main provider of energy reached a high level of dependence in the world economy. As its level of technical expertise increased, more efficient sources of fossil fuels were tapped, such as natural gas, and an entirely new form of energy, nuclear fission, became available. Renewable sources of energy, such as hydroelectric, wind and solar started to be tapped, but remained marginal sources.

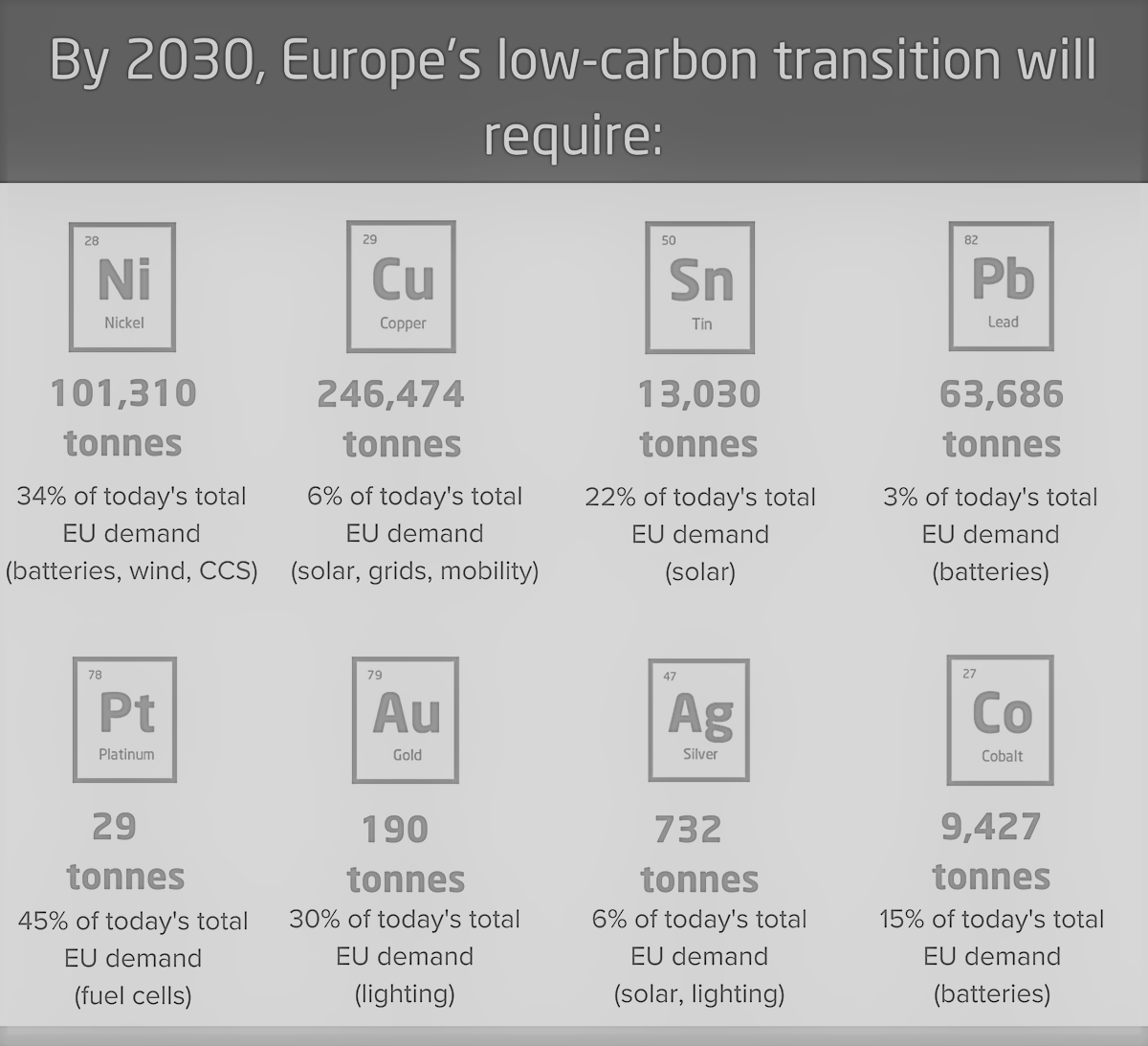

- The 21st century will be characterized by major shifts in energy sources with a gradual obsolescence of fossil fuels, like coal and oil, for more efficient fossil fuels such as natural gas. There may also be a substantial 'clean coal' technology potential (the term is more of an oxymoron). Advances in biotechnologies, underline the growing potential of biomass derived fuels while wind and solar energy will also account for a notable share of energy sources. Nuclear energy, particularly if nuclear fusion becomes commercially possible, may also play a significant role, but this remains speculative. A new transition is likely to be the usage of hydrogen, mainly for fuel cells powering vehicles, small energy generators and portable devices.

Investing in exploration and mining.

Worth the thought.